rhode island income tax withholding

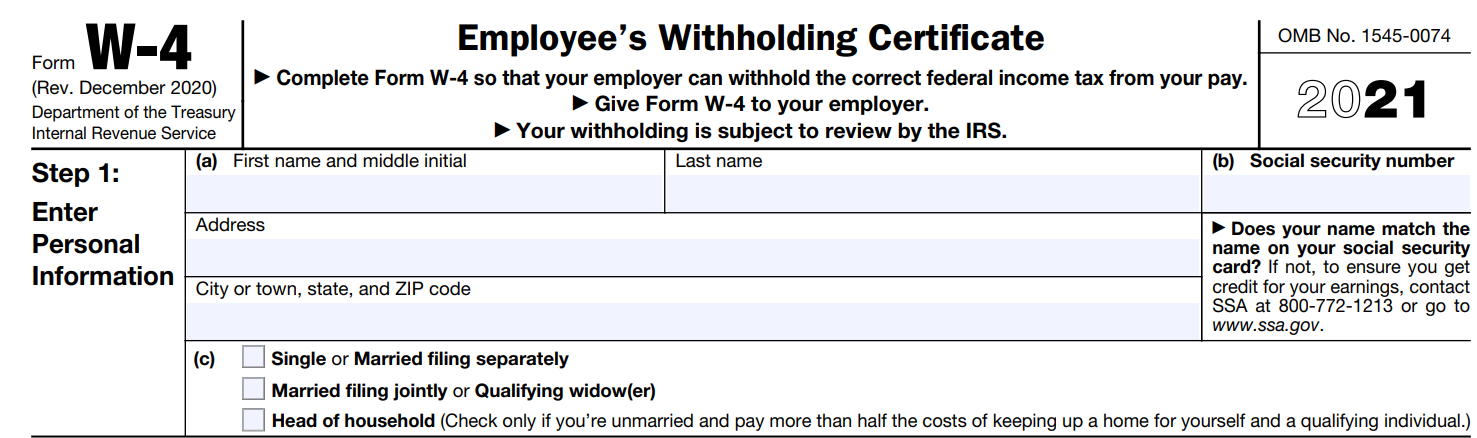

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. Rhode Island income tax must also be withheld from wages paid to Rhode Island nonresident.

Rhode Island Paycheck Calculator Tax Year 2022

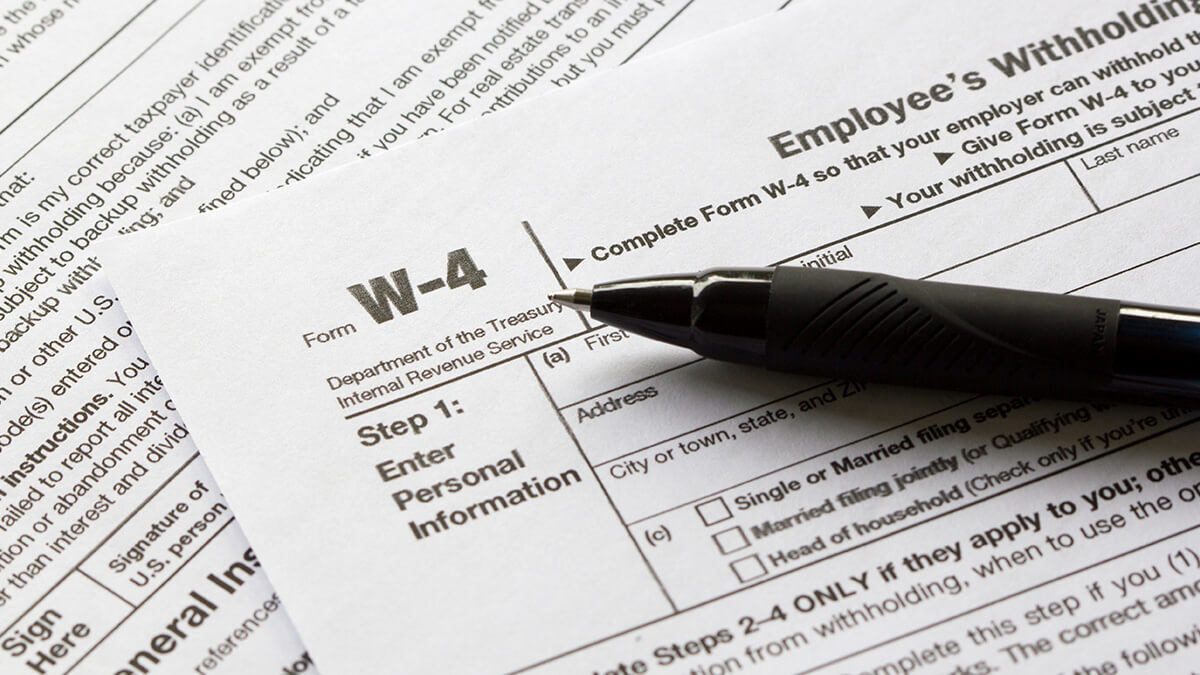

Personal Income Tax - Employers Withholding.

. An Official Rhode Island State Website. The income tax withholding for the State of Rhode Island includes the following changes. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

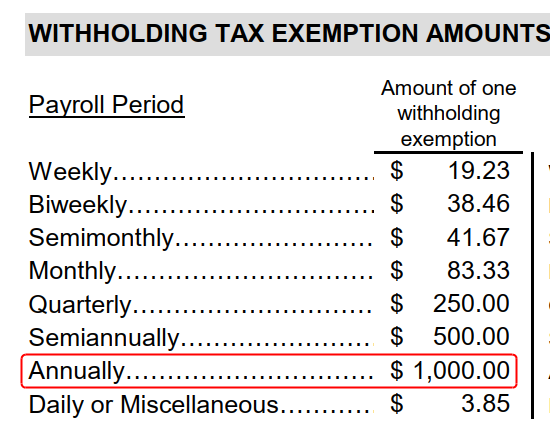

If you have questions related to the types of income subject to withholding contact. Rhode Island employer means an employer maintaining an office. The annualized wage threshold where the annual exemption amount is eliminated.

A the employees wages are subject to Federal. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. Wages paid to Rhode Island residents who work in the state are subject to withholding.

Any part of the wages were for services performed in Rhode Island. BAR Business Application and Registration PDF file less than 1mb. The income tax withholding for the State of Rhode Island includes the following changes.

The annualized wage threshold where the annual exemption amount is eliminated. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be. Residents and nonresidents including resident and.

1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services. Employers withholding Rhode Island personal income tax from employees wages must electronically file andor pay the taxes withheld to the Division of Taxation on a periodic basis. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if.

The annualized wage threshold where the annual exemption amount is eliminated. Prior Year 941Q Quarterly Withholding Return - ONLY FOR USE FOR PERIODS ON OR BEFORE 12312019 PDF file less. Personal Income Tax - Taxpayer Assistance Email.

Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. The employees wages are subject to Federal income tax withholding and. Employers withholding Rhode Island personal income tax from employees wages must report and pay the taxes withheld to the Division of Taxation on a periodic basis depending upon the.

Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer. Hold Rhode Island income tax from the wages of an employee if. The income tax withholding for the State of Rhode Island includes the following changes.

You must pay estimated income tax if you are self employed or do not pay. The table below shows the income tax rates in Rhode Island for all. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children.

State Income Tax Exemption Explained State By State Chart

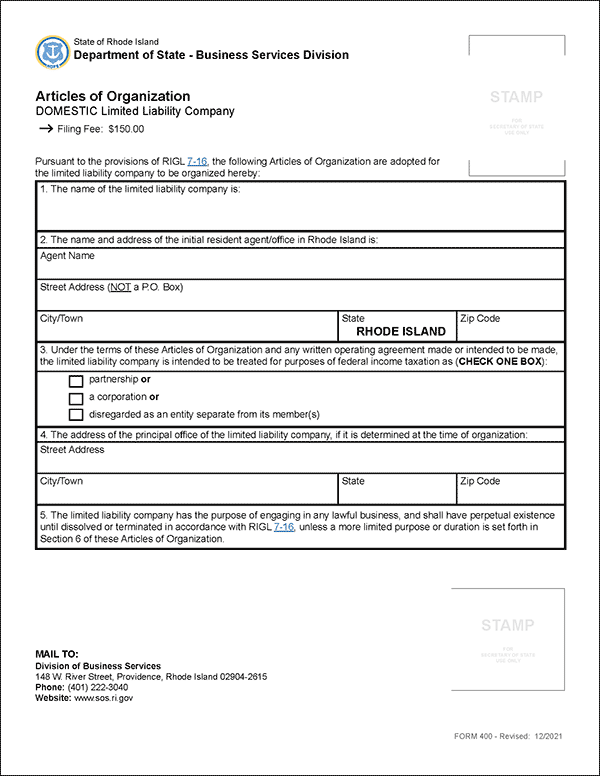

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

Powerchurch Software Church Management Software For Today S Growing Churches

Rhode Island Income Tax Brackets 2020

Rhode Island Income Tax Calculator Smartasset

Incorporate In Rhode Island Do Business The Right Way

Rhode Island Llc How To Start An Llc In Ri Truic

Ri Issues Reminder Taxes Must Be Paid On Unemployment Compensation

Download Rhode Island Division Of Taxation

Navigating State Withholding Requirements For Nonresident Employees Wolters Kluwer

State W 4 Form Detailed Withholding Forms By State Chart

A Complete Guide To Rhode Island Payroll Taxes

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

Rhode Island Form Wtqm Fill Online Printable Fillable Blank Pdffiller

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

2021 Payroll In Excel Rhode Island Withholding Edition Youtube